There are not many brave souls out there that venture into entrepreneurship and make it legal. I guess you dropped by because you must be planning on putting up a business and register it to make it official. Thus I salute you.

The DTI said that there were 820,255 business establishments operating in 2011, less than 0.5% of which were large enterprises. This means that close to a hundred per cent of these were micro, small, and medium enterprises or MSMEs.Yet, compared to the total employed of roughly 58 Million* in October of 2011 as reported by NSO, it can be deduced that the risk-takers out there who venture into business are a drop in a bucket.

Congratulations because you’re just not content on being employed. You want to be your own boss. Sure, opening up a business can be quite a daunting task. For starters, there are lots of regulatory bodies that you will need to register to, including the BIR.

Before reading ahead, please be reminded of the things you should know about TIN registration for self-employed or entrepreneur. These are tenets that every conscientious citizen must know, you may click here if you missed it.

If you’re absolutely sure you don’t have a TIN, then the good news is that there’s a handy tool that lets you apply from anywhere you are, at any time of the day.

TIN Registration For Self-Employed

You can get your TIN online for free. Just go to the BIR eRegistration System or eREG page.

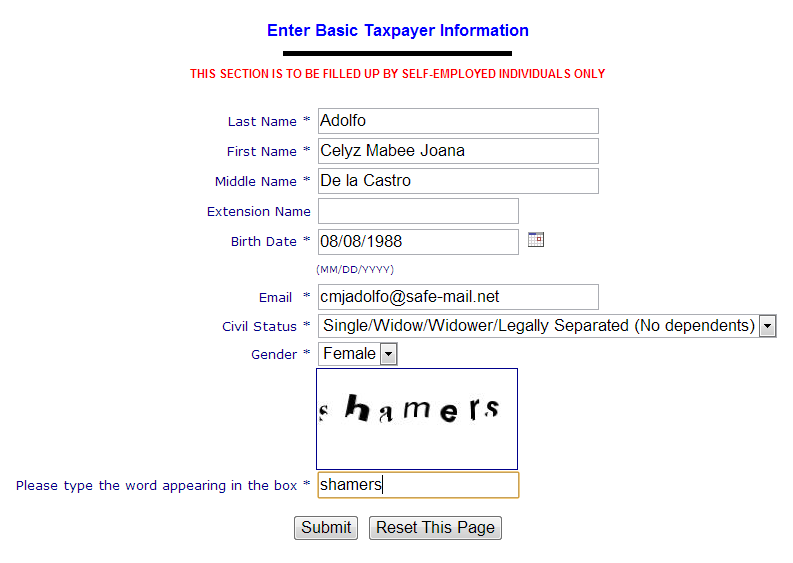

- Enter your basic information then click submit.

- Your name should be as it appears on your Birth Certificate.

- Be mindful in filling up the email address. You have to be absolutely certain that you will receive the system-generated message.

- Answer the drill questions honestly so that the system will know if you’re qualified to register yourself online.

Note that the BIR has a different connotation of the term “Professional”. This is an individual who receives remuneration on commission basis or by charging fees without employer-employee relation. These include freelance workers, sales agents, performing artists, tutors, lawyers, doctors and other professionals charging fees. Having a college degree doesn’t make you a “Professional” by BIR standards.

- Once successful, you will receive a link in your email. Click on the link and start accomplishing the online form. For help in accomplishing the form, you may click here to download the jobaids.

- You will receive your TIN and a system-generated BIR Form 1901 in your email. Isn’t that neat? Now print that form.

Rejoice for now you have a TIN! But wait, there’s more. You may need to proceed to the RDO indicated in your email, click here for the List of RDOs, to comply with other registration procedures, click here for more details on the documentary requirements.

I hope you’re not overwhelmed. Remember that the fruits of your hard labor will not just benefit you but our country as well. So go ahead, do carry on. Kudos to you and good luck!

Stay posted for more information on registering a business because there’s more in store for you!

~Debbi Fields

Views – 6820

Thank you Elizabeth!

Hi Alvin, you are welcome!

Hi Elizabeth, thanks for this! I’d just like to ask if I work part time (per seminar basis) and not considered as an employee, what TIN should I apply for? Thanks in advance!